The Of Insurance Brokerage

1) the service of offering an insurance firm or an individual that supplies a service referred to in paragraph (j) with an appraisal of the damage triggered to residential or commercial property, or in the instance of a loss of residential or commercial property, the worth of the building, where the distributor of the assessment examines the building, or when it comes to a loss of the property, the last-known place where the residential property was situated before the loss, (k) any supply considered by subsection 150( 1) or area 158 to be a supply of an economic solution, (l) the consenting to offer, or the setting up for, a service that is referred to in any of paragraphs (a) to (i), and also not described in any of paragraphs (n) to (t), or (m) a recommended service, (see section 3 of the Financial Solutions and Financial Institutions (GST/HST) Rules), but does not consist of (n) the payment or invoice of money as factor to consider for the supply of building apart from an economic instrument or of a solution aside from a monetary service, (o) the repayment or invoice of money in settlement of an insurance claim (besides an insurance claim under an insurance coverage plan) under a service warranty, guarantee or comparable arrangement in respect of residential or commercial property apart from a inancial instrument or a solution besides a financial solution, (p) the service of supplying guidance, various other than a service included in this meaning as a result of paragraph (j) or (j.

The Only Guide to Insurance Brokerage

2) a financial debt collection solution, provided under an agreement between a person consenting to provide, or scheduling, the service and a specific person besides the borrower, in regard of all or component of a financial debt, consisting of a solution of trying to gather, scheduling the collection of, negotiating the payment of, or recognizing or attempting to realize on any safety and security given for, the debt, but does look what i found not consist of a solution that is composed exclusively of approving from a person (besides the specific person) a repayment of all or part of an account unless under the terms of the contract the individual providing the solution might attempt to gather all or component of the account or may recognize or try to understand on any protection given for the account, or the major business of the person rendering the solution is the collection of debt, (r (Insurance Brokerage).

4) a solution (apart from a recommended service *) that is preparatory to the stipulation or the see this website possible provision of a solution described in any of paragraphs (a) to (i) and (l), or that is given together with a service described in any of those paragraphs, which is a service of accumulating, collating or giving info, or a market research, item design, record preparation, paper processing, consumer support, advertising or marketing service or a comparable service, (r.

The Buzz on Insurance Brokerage

— Cloud Links (@ldcloudlinks) December 20, 2022

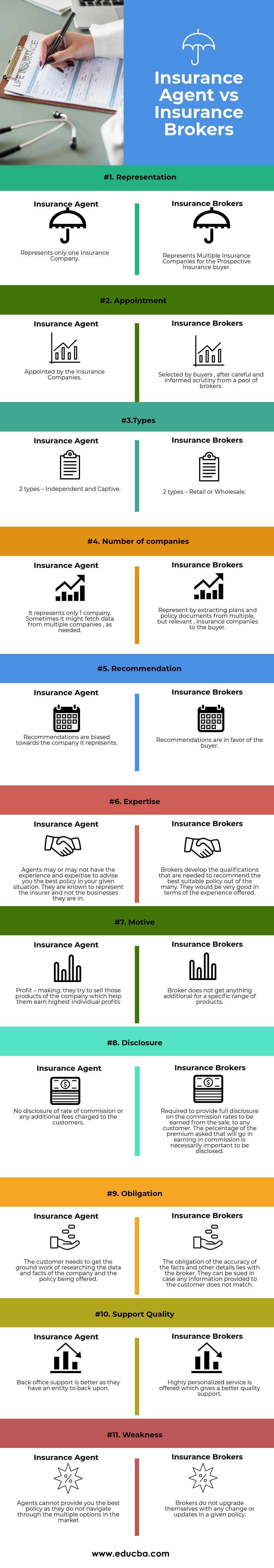

Brokers function with numerous insurance policy companiessometimes dozensso they have rather a few options. If the client purchases, the insurance coverage supplier will certainly pay the broker a payment.

In behalf of their consumers, brokers aid coordinate costs repayments, request policy modifications, as well as make suggestions come renewal time. Some brokers use help with the insurance claims procedure, though the actual insurance claim still has actually to be made directly with the insurance supplier. Brokers gain payment on Homepage the policies that they offer.

3 Easy Facts About Insurance Brokerage Described

The payment is based on the premium quantity and can be as high as 20%, depending on the type of insurance policy. Some brokers likewise bill a brokerage charge, which is paid by the customer, rather than the insurance coverage company.

About Insurance Brokerage

Insurance policy brokers are various from agents. Agents function for insurance coverage companies; brokers do not.

Insurance Brokerage Fundamentals Explained

Insurance coverage brokers are independent; they do not work for insurance policy firms., home to lots of easy-to-follow meanings for the most usual insurance terms.

Comments on “Insurance Brokerage Things To Know Before You Get This”